If you’re a Dealer Principal, chances are you already run a $1,000–$1,500 pack. That’s not unusual. It’s smart, it’s disciplined, and it’s probably been in place for years.

Let’s get one thing clear right up front: this isn’t about raising your pack. It isn’t about pushing your managers harder. It’s about what happens after you collect it and why a portion of it is quietly disappearing every single year.

READ: Titan Secure Stops Car Theft Before It Happens

The Problem No One Really Talks About

Today, most dealers treat their pack the same way they always have, as taxable income. It hits the books, gets taxed, and whatever is left over gets used or forgotten about. The issue? A meaningful chunk of that money never even makes it to you.

Let’s look at conservative, real numbers. Assume you sell 150 cars a month at roughly 85% penetration. That puts you at about 1,530 cars per year. Now focus on just $400 of your existing pack.

That $400, across 1,530 cars, equals $612,000 a year.

In New Mexico, with a combined tax rate of roughly 26.9% (21% federal and 5.9% state), about $164,000 of that money goes straight to the government every year.

You’re left with roughly $447,000. There’s no growth on it. No asset created. No long-term control. That money is gone.

READ: The Hidden Price of Auto Theft

Same Money. Completely Different Outcome.

Now let’s change absolutely nothing about how much you collect, only where it goes. Instead of taking that same $400 as traditional income, it’s moved into a dealer-owned reinsurance structure. The total is still $612,000. But now the rules change.

There’s no tax paid at funding. The income is deferred. The account is owned by the dealer, not a third party. Funds are invested conservatively, around 7%, with a clean 12-month earn-out. The product itself is a hard add, non-cancellable and earned once the loan is funded. The result? Instead of writing a six-figure check to the IRS and the state, you keep 100% of that capital working for you.

This is exactly why most CPAs will tell you that anything over roughly $325 per car starts to outrun the tax burden. At $400–$500, it’s not even a debate.

Why This Actually Performs

Performance matters, and this isn’t theoretical. Actuarial data in New Mexico shows theft reinsurance loss ratios around 0.2%. That’s a fraction of what most dealers see with cancellable products.

Compare that to:

VSCs with cancellations

GAP with refunds and unwinds

Long-tail products with chargebacks

This structure outperforms because it’s simple:

Hard add

Non-cancellable

No refunds

No chargebacks

Only a 12-month burn-off

What This Looks Like Over Five Years

Let’s stay conservative and continue using $400, not $500. Over five years, approximately $612,000 is moved annually, resulting in roughly $3.06 million contributed. That portfolio grows to about $3.7 million or more, while nearly $800,000 in taxes is deferred or avoided simply by not paying tax upfront. That’s real money, money that would normally just disappear. Instead, it compounds over time, and you control

Titan Secure: More Than Just Reinsurance

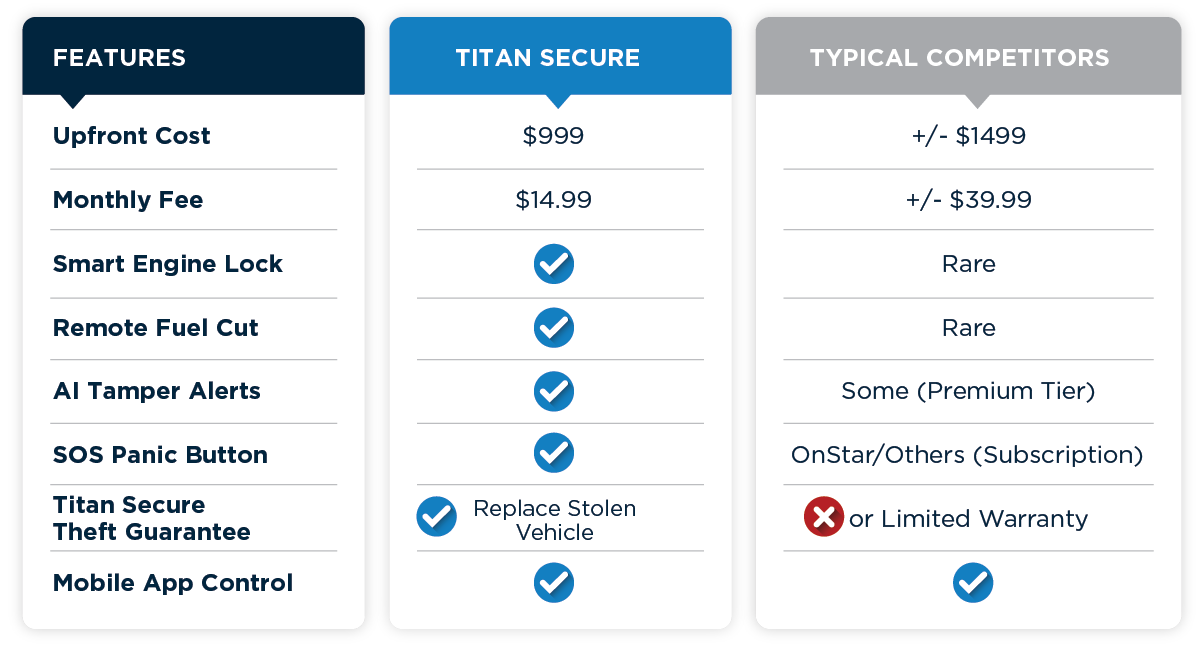

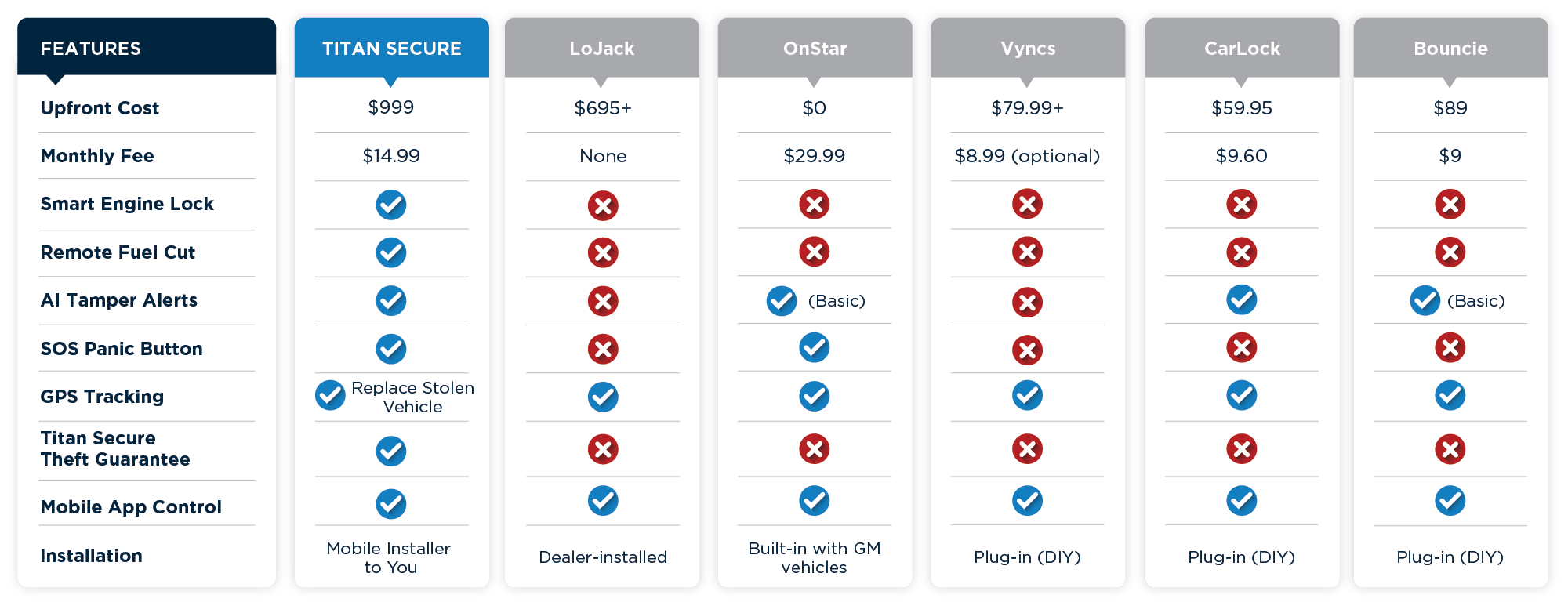

Titan Secure isn’t just a box on the car.

We handle the operational side, so the program stays effortless:

Installations

Removals for trades and no-sales

Inventory and lot management

Vehicle location and time-in-inventory

Battery monitoring and replacement management

Everything is done on consignment. There’s no upfront expense, and you only pay when a car sells.

What This Means for Your Profitability

You already collected the pack. You can continue to take it as income, pay roughly 27% in taxes, and watch it disappear, or you can redirect a portion of it into something you actually own. Keep your $1,000 pack, move $400–$500 into reinsurance, pay less tax, build an asset, let it compound over time, and retain full control over when and how it’s distributed.

This isn’t about selling you another product. It’s about showing you how to stop giving more than necessary to the government and start paying yourself instead, using money you already collect. That’s Titan Secure.